1

/

of

3

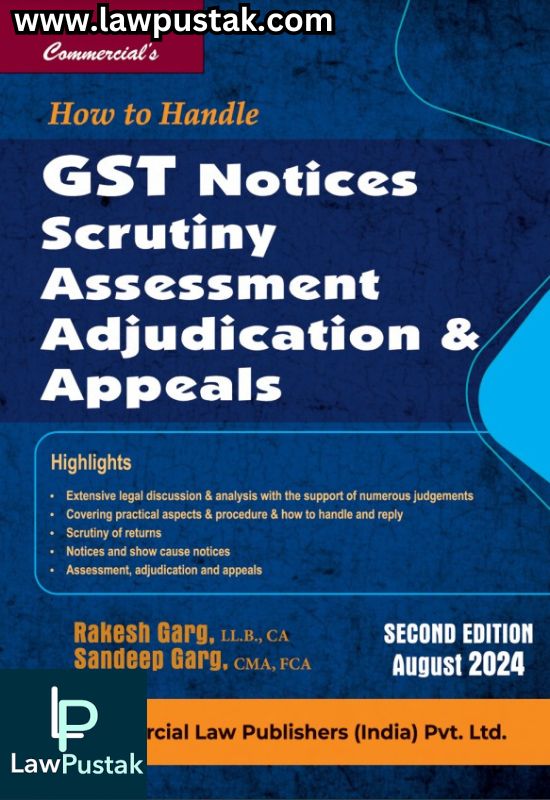

How to Handle GST Notices Scrutiny, Assessment Adjudication & Appeals By Rakesh Garg & Sandeep Garg - 2nd Edition August 2024 - Commercial Law Publisher

How to Handle GST Notices Scrutiny, Assessment Adjudication & Appeals By Rakesh Garg & Sandeep Garg - 2nd Edition August 2024 - Commercial Law Publisher

Regular price

Rs. 997.00

Regular price

Rs. 1,295.00

Sale price

Rs. 997.00

Unit price

/

per

Shipping calculated at checkout.

No reviews

Couldn't load pickup availability

How to Handle GST Notices Scrutiny, Assessment and Adjudication As Amended by Finance Act, 2023-Commercal's Learn the latest amendments to GST notices for scrutiny, assessment, and adjudication, with Commercial's guide. Benefit from expert advice and comprehensive knowledge of the applicable laws to ensure compliance. Get up-to-date information on the Finance Act, 2023. Ensure compliance with the latest amendments to GST notices for scrutiny, assessment, and adjudication through expert advice and comprehensive knowledge from Commercial's guide. Stay informed with the most recent updates on the Finance Act, 2023.